Funds managed

| Fund name | Asset Class | License |

| Dream Fund I | Early Stage (Real Estate) | SEBI CAT 2 |

| Arthveda Star | Early Stage (Real Estate) | SEBI CAT 2 |

| Asha Fund | Early Stage (Real Estate) | SEBI CAT 2 |

| Fund name | Asset Class | License |

| ARTHVEDA AFFORDABLE HOUSING TRUST | Real Estate | SEBI AIF Cat 2 |

| ArthVeda Housing Trust | Real Estate | SEBI AIF Cat 2 |

About the AMC

ArthVeda Fund Management Pvt. Ltd. (AVFM or ArthVeda) was established in 2005 and was earlier known as DHFL Venture Capital India Pvt. Ltd. (DHFLVC). ArthVeda is a wholly-owned subsidiary of Wadhawan Global Capital Limited.

Wadhawan Global Capital Limited provides financial services: lending, investments, protection, strategic investments, housing and education loans, mutual funds, asset management, and insurance services. Wadhawan Global Capital serves customers in the United Kingdom and India.

Structure

Key staff

Bikram Sen- Currently Director and CEO at Arthveda Fund Management Pvt. Ltd. Having done LLB in Taxation, Corporate and Commercial LAw, he started his career as Attorneys at Law in Thakordas & Madgaonkar followed by Consultant in Income Tax. Has previously been CEO of DHFL, the SOROS- CHATERJEE group, Also worked with American Express Bank Ltd. as Indian Director and Head of Trading Products Group. He has served as the MD, HEad and Merchant Banker at Chemical Securities, Manufacturer Hanover Ltd. and SBI respectively. Also been Foreign Exchange and Money Market dealer in SBI. Has qualified in B.A., English Literature, Philosophy (Logic). Has also done sloan fellowship from London Business School in Investment Management, Corporate Finance and Business Strategy. https://www.linkedin.com/in/bikram-sen-a286aa103/

Rajiv Maheshwari is the Chief Investment Officer at ArthVeda Fund Management.

Investment philosophy (for firm)

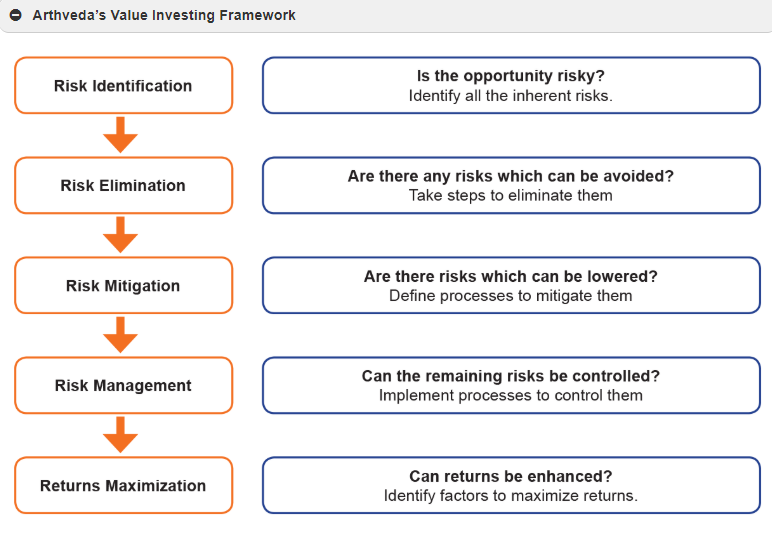

ArthVeda’s investing philosophy is based on “Value Investing” in real estate. By using this approach, they believe, a discount in intrinsic value gives a margin-of-safety, causing low risk, and high returns are automatic as one pays a low price.

Source: ASHA Fund

Source: ASHA Fund

Source: ASHA Fund

Source: ASHA Fund

ASHA Fund

ASHA is ArthVeda’s third Real Estate Fund with a focus on Affordable Housing for Low Income Groups (LIG) in outskirts of Metros, Tier 1/ 2/ 3 cities. The fund replicates the strategy of ArthVeda’s Middle Income Housing Fund, STAR Fund, to Low Income Housing (LIH) with much stringent norms. ASHA follows the tenets of value investing to deliver superior risk adjusted returns. Investment destinations have been carefully screened based on a rigorous secondary research and interactions with industry participants.

Source: ASHA Fund

- Asha Fund

- This fund was focused on affordable housings for LIGs in the outskirts of metro and tier 1/2/3 cities.

- Raised 150- 200 crores.

- Out of the total funds raised as on 31st March 2019, 74.84% were raised by 65% of the individuals. On the other hand remaining 25.16% were raised by 35% of the investors which were various companies.

- This fund is particularly for the projects that have quick turn-around and fast exits. The tenure of this fund is the shortest among all the funds related to real estate.

- Small investments with small investment ticket size.

- This fund has been diversified across pan- India locations along with various many builders.

- It provides highest IRRs with downside protection.

- The investment strategy of ASHA has achieved it to gain a sweet-spot in the terms such as:

- Diversification

- Attractive Return

- Short Fund Life

- Strategies like these can be only implemented by Arthveda because of its requirements of on-ground presence and relationships with stakeholders across India.

2. Arthveda Star

- Second real estate fund.

- Size- USD 46 million

- Investments from HNIs and domestic institutes which raised funds equal to Rs. 2 billion with greenfield funds of Rs. 1 billion.

- Focused on mid- income housing facilities in smaller cities (1.5- 4million per unit).

- 75% of its investments will be done in Tier II and Tier III cities along with metro outskirts across India.

- Project to be sold at Rs. 2000 to Rs, 4ooo per sq. ft.

- Investment for 24- 36 months.

- Find deployment investment ticket size between Rs. 50- 200 million.

- Aimed to invest in equity and equity like instruments in SPV (Special Purpose Vehicle)

3. Dream Fund

- Size- INR 1010 million

- First fund of the company to get launched in 2006.

- Investments from HNIs including corporates and individuals, banks and institutions.

- Gross IRR- 17% pa. (before tax, expenses and carry).

Media

ArthVeda raises $250 mn for affordable housing in debut offshore fund, February 6, 2017

https://www.vccircle.com/ArthVeda-raises-250-mn-affordable-housing-debut-offshore-fund/

ArthVeda had received a commitment of $250 million from Qatar Holding LLC towards their affordable housing fund. According to Bikram Sen, CEO, it’s the first significant foreign investment in India’s affordable housing segment, since the government’s impetus towards the sector in the FY 2017-18. “ArthVeda’s affordable housing fund leverages our entire group’s leadership in the low- and mid-income lending segment and applies that to investments in affordable housing,” said Kapil Wadhawan, chairman and managing director of DHFL and ArthVeda. The firm has raised domestic real estate funds earlier apart from the affordable housing fund. Earlier, it managed two funds—Dream Fund I and Star Fund I—which has a total asset under management (AUM) of $40 million. The first fund had been fully exited and the company claimed to have clocked an internal rate of return (IRR) of 7-45%.

Realty funds face uphill task in raising, deploying capital for projects, April 23, 2018

More than a year after a large foreign investor committed to invest $250 million in Arthveda Fund Management Pvt. Ltd’s affordable housing Fund, the commitment had lapsed with the latter not drawing down the money. Bikram Sen said the firm is now focused on exiting and returning capital (from its previous investments) fast.

“Deployment remains a challenge though there is tremendous demand for capital. There are opportunities to deploy in distressed projects but developers need to be realistic. Funds need to take more control of the way inventory should be priced among other things,” he said.

Analyst questions

- What was the idea behind investing into real estate funds as your basic principle is dependent on Value Investing? Also, not many firms had done it before with similar principles.

- Arthveda Star Fund which is a real estate fund, has been investing in SPVs. Why?

Prepared by – Avanti N, June 2020

- What are the different projects that ASHA Fund is currently invested in?

- What exit strategies do you prefer for real estate business?

- In the long run, how profitable is using value investing in the affordable housing sector?

Prepared by- Bhavna Mundhra, June 2021

You must be logged in to post a comment.